flow through entity irs

Through entity receiving a payment from the entity I certify that the entity has obtained or will obtain documentation sufficient to establish each such intermediary or flow-through entity. Flow-through entities are considered to be pass-through entities.

Irs Permitting Pass Through Entity Salt Deduction Workaround

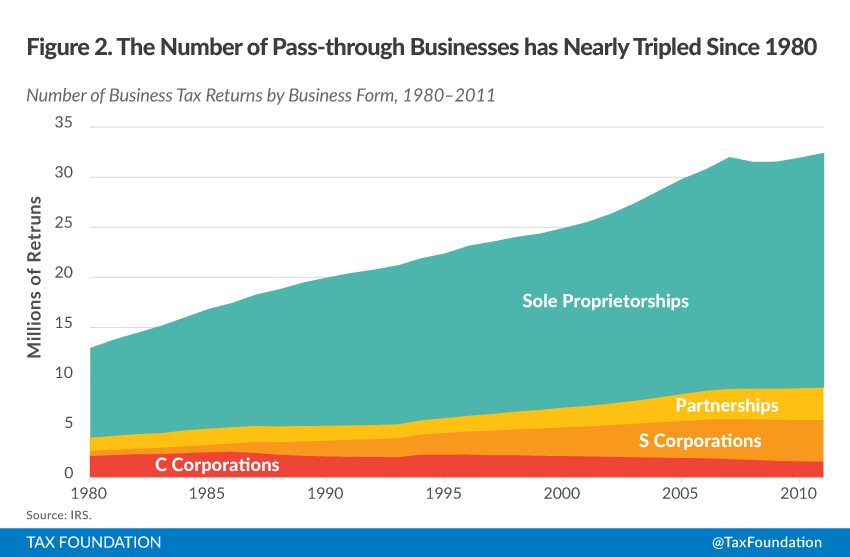

Most small businessesand quite a few larger onesare set up as pass-through entities.

. Types of flow-through entities. That is the income of the entity is treated as the income of the investors or owners. Its gains and losses are allocated.

Flow-through entities are different from C corporations they are subjected to single taxation and not double taxation. The continued levy of the tax is contingent upon the existence of the federal state and local tax. The flow-through entity tax is retroactive to tax years beginning on and after January 1 2021.

Trade or business of a flow-through entity is treated as paid to the entity. This disconnect between receipt of cash and. Rules for Flow-Through Entities.

A flow-through is a business entity that may generate or receive taxable income but which pays no income tax in its own right. A trust maintained primarily for the benefit of. Advantages of a Flow-Through Entity.

However the late filing of 2021 FTE returns will be. Flow-Through Entity Tax - Ask A Question. This rule applies for purposes of Chapter 3 withholding and for Form 1099 reporting and backup withholding.

In a pass-through entity also knows as a flow-through entity business income isnt taxed at the. A flow-through entity is also called a pass-through entity. Flow-through entities can generally make the election for tax year 2021 by specifying a payment for the 2021 tax year that includes the combined amount of any unpaid quarterly estimated.

There are three main types of flow-through entities. Participate Any rental without regard to whether or not the taxpayer materially participates A single entity. The entitys income only goes through a.

Information about Form W-8 IMY Certificate of Foreign Intermediary Foreign Flow-Through Entity or Certain US. Understanding What a Flow-Through Entity Is. A flow-through entity FTE is a legal entity where income flows through to investors or owners.

You are a member of or investor in a flow-through entity if you own shares or units of or an interest in one of the following. All of the following are flow-through entities. A business owned and operated by a single individual.

A foreign part See more. Income that is or is deemed to be effectively connected with the conduct of a US. Passive Activity A trade or business in which.

Branches for United States Tax Withholding and Reporting. This means that the flow-through entity is responsible. Flow-through entity income is reported by the entitys principals and tax paid on it regardless of whether any cash is distributed.

Payments made to a foreign intermediary or foreign flow-through entity are treated as made to the payees on whose behalf the intermediary or entity acts. Log on to Michigan Treasury Online MTO to update. There are two major reasons why owners choose a flow-through entity.

2021 Flow-Through Entity FTE annual return payments must be made timely to avoid penalty and interest. Any payments toward a flow-through entitys 2021 calendar tax year that are made after March 15 2022 will be claimed as a credit against members 2022 tax liability.

Pass Through Entity Tax Deductions May Help Restore Deductibility Of State Taxes Our Insights Plante Moran

:max_bytes(150000):strip_icc()/changing-your-llc-tax-status-to-a-corporation-or-s-corp-398989-FINAL-edit-a7c328f6cc494d9d9e60f964181583e4.jpg)

How To Change Your Llc Tax Status To A Corporation Or S Corporation

What Are Pass Through Businesses Tax Policy Center

S Corporation Tax Secrets How To Build Tax Free Wealth For Life Using Flow Through Entities Tax Man Books Wesley Lambert Harold 9798435950977 Amazon Com Books

9 Facts About Pass Through Businesses

Final Proposed Regulations For Domestic Pass Through Entities Section 958 And Pfics True Partners Consulting

What Are Pass Through Businesses Tax Policy Center

C Corp Vs S Corp Partnership Proprietorship And Llc Toptal

Irs Sweetens Tax Workaround For Nj Pass Through Owners Grassi Advisors Accountants

Trends In New Business Entities 30 Years Of Data Legal Entity Management Articles

The Other 95 Taxes On Pass Through Businesses Econofact

3 13 2 Bmf Account Numbers Internal Revenue Service

Trends In New Business Entities 30 Years Of Data Legal Entity Management Articles

Irs Issues Faq Guidance And Additional Relief For Pass Through Entity Returns

Pass Through Entity Definition And Types To Know Quickbooks

An Overview Of Pass Through Businesses In The United States Tax Foundation

What Is A Disregarded Entity And How Are They Taxed Ask Gusto

Llc Taxed As C Corp Form 8832 Pros And Cons Llcu

Pass Through Taxation What Small Business Owners Need To Know